Typically, when you complete your return using tax preparation software, there will be an option to download your return as a PDF. This is usually found in the ‘File’ or ‘Document’ menus.

PDF is a cross-platform format that looks the same on Windows, Macintosh, and Unix systems. The IRS uses this format for most forms and publications.

What is a PDF file?

A PDF (Portable Document Format) file is a digital document that can be viewed on any device, regardless of the software or hardware used to view it. PDF files are commonly used for documents like user manuals, eBooks, application forms, scanned documents, and more. Adobe developed the PDF file format in the 1990s to accomplish two things. First, it allows people to share documents without having the same word-processing software as the person they’re sharing them with. Second, it ensures that the document’s layout and formatting are preserved no matter what software or equipment is used to open it.

PDFs can contain a variety of elements, including text, images, embedded fonts, hyperlinks, video, interactive buttons, and more. They can be edited using PDF editing tools, which are usually available in many different web browsers and third-party apps for macOS and Windows. They can also be created from a variety of programs, such as word processors that have virtual PDF printers (like novaPDF) or graphic design apps that allow you to create PDFs by printing them out.

In addition to the basic viewing functions of a PDF, it’s possible to add interactive features like form fields and text notes, links, and three-dimensional objects using U3D and PRC data. The PDF specification also includes security features such as encryption and digital signatures.

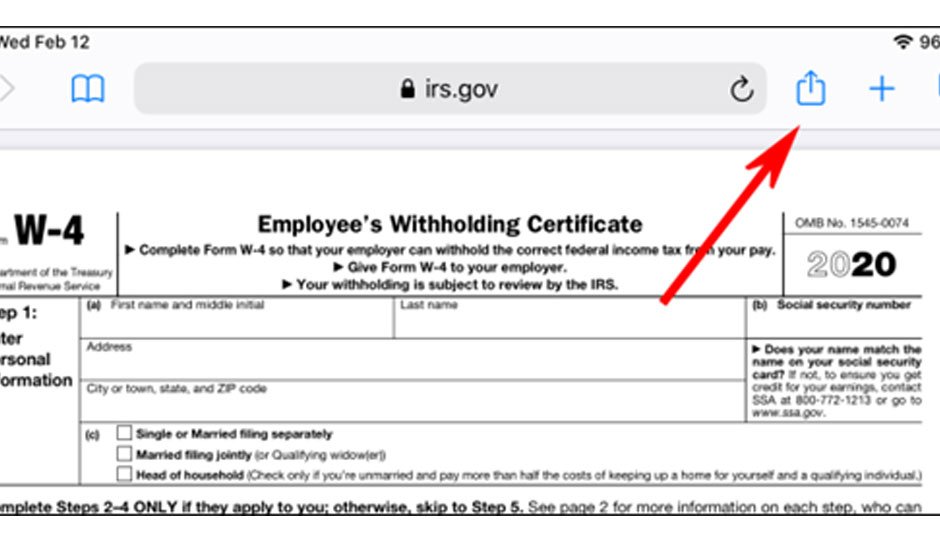

When you log into your tax filing platform or service, look for a button that says something like “View PDF” or “Download PDF”. If you see this option, click on it to download your return as a PDF. The PDF will then be automatically opened in the appropriate software or app on your computer or mobile device.

If you’re trying to edit a PDF, make sure the software you’re using is compatible with this format before you try to make any changes. There are lots of different tools out there for creating, editing, and converting PDFs, so be sure to do some research before you choose one. Some of the most popular options include Adobe Acrobat, Microsoft Word, and various free-to-use online PDF editors such as PDFescape, Canva, DocHub, and PDF Buddy.

PDF files are Portable Document Format files

If you have ever downloaded a form or document from the Internet, it is likely that it was in PDF format. PDFs are one of the most popular file formats today and have become very versatile. They are able to contain images, forms, hyperlinks, text, and interactive buttons. In addition, they can be opened with any web browser or Adobe Acrobat Reader software.

Developed by Adobe Systems, the PDF file format was created in the 1990s to allow documents to be displayed on a computer in a manner independent of application software, hardware, and operating system. It is an open standard managed by the International Organization for Standardization (ISO). It has a very high level of security and accessibility. PDFs are easily readable on most devices and can be edited or printed.

PDF files are highly compressed, allowing complex information to be contained in a very small file size. They also preserve most attributes of the original document, including fonts and graphics. These features make them very useful for electronic distribution and viewing. Almost all modern desktop publishing applications support the PDF format. It is also very compatible with printing from a wide range of printers, both laser and inkjet.

When you click on the download button for your tax return, it should begin downloading to your device as a PDF file. You can then view the IRS free file in your preferred software program or use a tool such as PDFescape, Canva, or PDF Buddy to edit and fill out the form.

To download a PDF, you must have a device that supports PDF files and an internet connection that is capable of downloading large files. You may need to install a free plugin or application for your browser or other software to support PDF files. Additionally, the website or tax platform from which you are downloading may have specific system requirements that should be met.

Once you’ve logged into your account, navigate to the section that contains your completed returns. Look for a “Download” or “View” button that is usually represented by an icon such as a downward-facing arrow or cloud. Once you have clicked on this icon, your return should begin downloading to your device as a secure PDF file.

PDF files are readable by Adobe Acrobat Reader

If you have Adobe Acrobat Reader installed, you can open PDF files from any web browser or from most online tax platforms and services. Acrobat Reader is free and available for Windows, Mac, iOS, and Android devices. If you aren’t sure if your device or operating system supports PDFs, check the requirements on the tax platform or service website to make sure.

A PDF is a machine-readable file that contains tokens, or blocks of bytes, which can be grouped into syntactic units following specific rules and assembled into higher-level objects, such as paragraphs, sentences, words, and letters. The position of each token on the page is also recorded, which allows computers to read the file and extract the information it contains. The PDF format allows for a high-fidelity representation of documents and presentations, regardless of the hardware or software used to view them.

Some PDF documents are text-only, while others have images or other graphics. PDF files with text are readable by almost any computer and software program, making them ideal for sharing documents with people who use different computers and programs. However, it is important to note that PDFs do not always preserve the original formatting of documents when converted to other formats. This can lead to errors or misinterpretation of the document.

Many forms and publications on the IRS website are available in PDF format. In most cases, these documents are readable using any common browser and can be saved for later reference or printing. Some forms and publications are also available in HTML, XML, or other formats. If you are unable to download a form, contact the agency directly for further assistance.

If you want to search for a particular word or phrase in a PDF document, you can convert it into an editable document by using Adobe Acrobat’s built-in Optical Character Recognition (OCR) feature. This process transforms scanned images into text that any PDF program can search. Alternatively, you can take a screenshot of the PDF document on your phone or tablet and import it into Adobe Acrobat, which will automatically recognize the text and turn it into searchable content.

PDF files are secure

While PDF files offer a variety of security features, they are not impenetrable. There are ways to make your PDF file more secure, such as encrypting it with a password, which will prevent unauthorized access to the document. However, it’s important to note that this type of security measure only keeps your PDF secure as long as nobody knows the password. If someone does find out the password, they will have complete access to the contents of your document and can even modify it in ways that you may not want.

You can also use a tool called Locklizard to add security to your PDF file without adding a password to it. This online service is free and uses government-approved strong encryption protocols to protect your documents. It also provides a free trial version of its software for you to try out before you decide whether to purchase it or not.

Another way to keep your tax PDF file secure is to use a virtual data room like CapLinked. This solution offers industry-leading security features to ensure that your confidential information stays safe and is only accessible to authorized individuals. This is especially helpful when transferring sensitive data during business deals, mergers, and acquisitions.

The most common way to secure a PDF file is to use a password. This will keep unauthorized users from viewing the content of your document and will prevent them from printing or saving it in a different format. To set a password, you can use the “Password” field in the PDF settings menu.

To prevent unauthorized printouts and other actions, you can also use the “Actions Allowed” and “Page Extraction is Not Allowed” fields in the PDF settings menu. This will stop unauthorized users from taking screenshots of your document and using them to steal your information.

In addition to protecting your documents with a password, you can also use digital signatures on PDF files to sign them electronically. This is particularly useful when you need to submit documents online. To sign a PDF file, you must have a software program that supports digital signatures, such as Adobe Acrobat or PDFelement.